The Baby Steps are a tried-and-true method of paying off debt, having paved the way toward financial freedom for millions of people, including us, the Clumsy Gazelles. Baby Step 1 ($1000 emergency fund) and Baby Step 2 (pay off non-mortgage debt) generate emotions that, along with the financial logic, drive many people to erase debt – again, including us. But then, Baby Step 3 was much less exciting for us.

I’m gonna be brutally honest here for a minute: saving 3 months of expenses (or more) is BORING, compared to the passionate chase to complete steps 1 & 2. To stay motivated on Baby Step 3, your perspective should shift; the emotion changes from urgency to peace. Stay motivated by tracking your progress, however quickly or slowly it may be – progression is the goal! Visual aids can help, either in tangible paper form or via a digital chart on an app. When you’ve finished Baby Step 3, celebrate your accomplishments! Pick a reward to enjoy and give yourself permission to acknowledge that you went from being financially in a hole to standing on a mountain!

Why are Baby Steps 1 and 2 easier? The emotions are WAY different, as we discovered during our journey.

Driving Emotions in Baby Steps 1 and 2

Understanding the limiting nature of debt and realizing that hard work is the ticket to freedom often leads to a motivating passion to dig deep and fix this. Watching the debt balance dwindle with each payment stokes the fire you lit under yourself. Payoff become more tangible with every debtor struck off your list – another XYZ credit card/bank/loan/whatever is out of your life! When you recalculate your estimated payoff date over and over (or was it just this budget nerd doing that?) and try to squeeze a little more out of your budget to get it done faster, there’s definitely an air of excitement and anticipation. Then finally, the feeling of reaching your goal of payoff is nearly indescribable! You did this, Baby Step 2 is over and now you feel as if you can do anything! Emotion, combined with steady feedback that focused work equals progress against the “enemy” of debt, is a powerfully motivating force!

Urgency to Peace in Baby Step 3

But Baby Step 3 isn’t the enemy, so you don’t have the passionate, almost angry emotion that drove you in Baby Step 2. You’ve switched from defense to offense – you no longer pay others, you are now, maybe for the first time ever, you have money left over at the end of the month! Don’t get me wrong – there is a different kind of peace knowing that we own everything but the house now. There’s a strong feeling of accomplishment that we reached a goal we set and worked hard for. There is the confidence we can handle unexpected expenses without panic. There is also the new feeling that the money left over every month is staying with us, not going to someone else.

However – Baby Step 3 is a tough one. The money we save, it’s a safety net. Not to be touched unless absolutely needed. It’s not like a sinking fund, where I know I’ll be spending it on a schedule determined by the need. It’s not like hanging on to my Christmas money until I know exactly what I want to spend it on (or am I the only weirdo who doesn’t spend Christmas gift money until Spring?).

Baby Step 3 is money almost without a purpose or schedule. It’s a little scary, actually. We’ll only spend that money if/when something bad happens. It might be next month, or 3 years from now. It’s our protection from going back into debt when life happens. But it’s money we won’t spend with joy – it will be spent with relief that we have it, that we planned ahead for something so unexpected.

Saving money, when you aren’t used to doing it, can be very hard! Or, like us, you are so out of practice and so brainwashed by the “gotta have it now” mentality, that you don’t even know the last time you actually saved money for a purpose, instead of spending every dime until you don’t have any more. It’s like a muscle; saving money is a muscle that requires effort to stretch and strengthen.

Starting Small – Progress Over Time

We started training ourselves with small goals by creating sinking funds and saving money for a specific purpose: auto insurance renewals are one we were very good at. That muscle is strong, because we’ve used it every month for years and years! Last year we tried our hand at a monthly Christmas sinking fund, and it worked SO WELL. Having that cash ready for gifts, instead of loading up the credit cards like we used to do and paying them off later, it was SO PEACEFUL. When Christmas was done, it was DONE – not lingering around months later.

The next chance we had to strengthen our saving muscle was for trips we took last year. A family wedding out of state, a long weekend getaway for our anniversary – both very important trips we committed to saving for long before we left home. The wedding trip, well, we didn’t budget well for that, and ended up going over and having to make up the difference with creative movement in our monthly budget. The anniversary trip? We came back with 20% of our budgeted money, and we were ridiculously happy with that accomplishment!! Progress over perfection, right?

So, as I considered these opportunities we’ve had to grow stronger in our ability to save, 3 months of expenses really was the next step in the process. It was hard, but that’s because we mastered the easier stuff, and we were moving into really life-changing efforts now. And I know that when the situation happens that we need this emergency fund, we are going to be SO GLAD it’s there.

Track Progress – It’s Actually Fun!

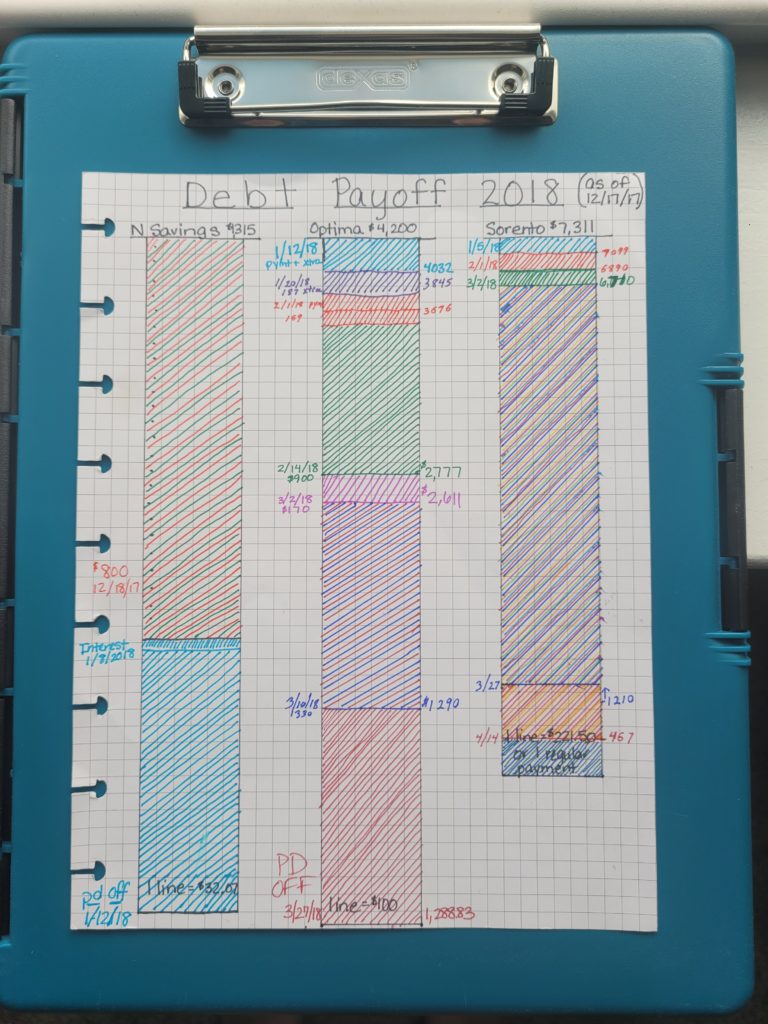

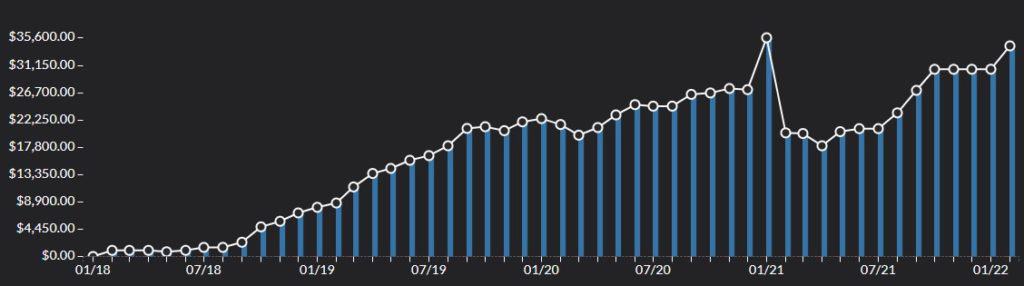

Just like we tracked our debt payoff with a visual chart, we tracked the progress of Baby Step 3 in YNAB with a goal amount and percentage saved. Every contribution we made, no matter how large or small, displayed as progress to our goal. Even when the percentage was seemingly low, say under 50%, I would refocus on the dollar amount – those dollars were ours to keep! A hand-drawn chart on the fridge, an app on your phone, or a downloaded pdf from the #debtfreecommunity on Instagram that you color in – if it helps you stay motivated to track your progress, DO IT!

Infrequent Contributions are Boring Too

We realized contributing to our emergency fund only once per month was a bit disheartening, even though it was a substantial amount, so we changed it to smaller contributions every payday (every 2 weeks for us). One contribution is much larger than the other, and they still total to the monthly amount, but it feels like we are making more progress when we can put money in the account every other week. The shorter timespan between progress gains helped us stay focused on the 2 weeks until the next contribution, not the longer span of a big chunk every month.

An Accomplishment to Celebrate!

Now it’s been a few years since we completed Baby Step 3, and we still frequently look at the balance on the account, and intentionally take a moment to recognize that the value displayed there is for our safety, for our protection, and is more than we’ve ever had in savings! It still brings a feeling of peace and security that we can handle an emergency.

Baby Step 3 won’t last forever for you. Keep working to reach your goal, move on to the next steps, and on some very bad day in the future, you will use those funds for an emergency and be so very thankful you didn’t give up on boring Baby Step 3!