What categories should you use in your personal budget? Do you need sub-categories? Deciding to write out a budget can be hard enough without worrying about how many lines you need. Since we started doing a written budget monthly in 2016, we’ve settled on these categories and sub-categories, and they have served us well to track our spending, from with unplanned expenses to the most basic monthly bills! Also, if your budget will include multiple bank accounts, at the end of this article I’ll give you a tip on how to keep track of which part of your budget lives in which account!

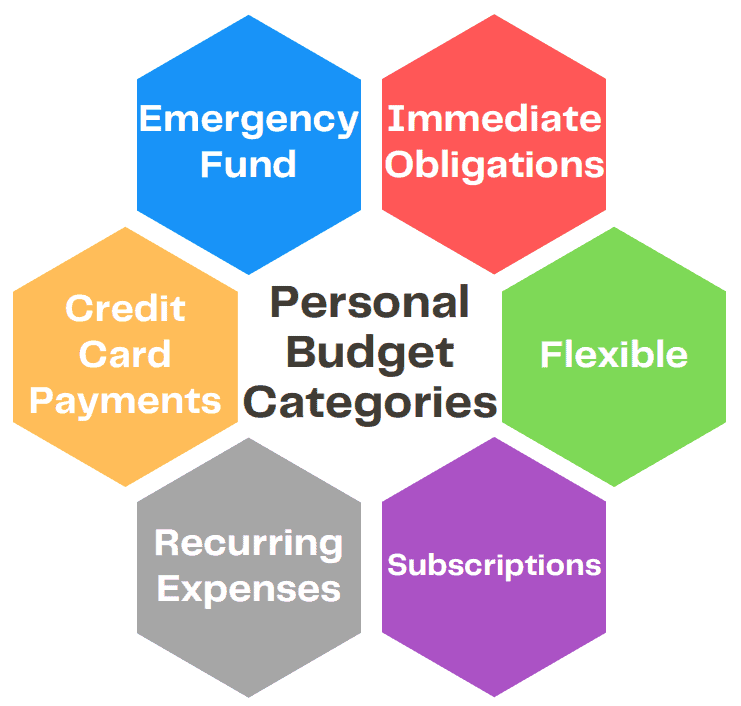

Our 6 main budget categories include

- Immediate Obligations

- Flexible

- Subscriptions

- Recurring Expenses

- Credit Card payments

- Emergency Fund

Each category has sub-categories for more specific items, but generally we find that all expenses fall somewhere under these headings. The nice thing about budget categories is that you can create as many as you need to include your spending and saving needs!

Let’s take a look at what falls under each main budget category listed above.

Immediate Obligations

This category is where our monthly bills are listed – for example, we have sub-categories including the mortgage, utilities, cell phones, and childcare. When we had car payments, they were listed in this category also. These are all expenses that are pretty much required to live, and cover the suggested areas of “Housing” and/or “Transportation” in nearly every budget guide ever written. Immediate Obligations is near the top of our budget as we built it in You Need A Budget (YNAB), because it’s pretty much the first place we delegate money on payday. These bills have priority to be paid on time!

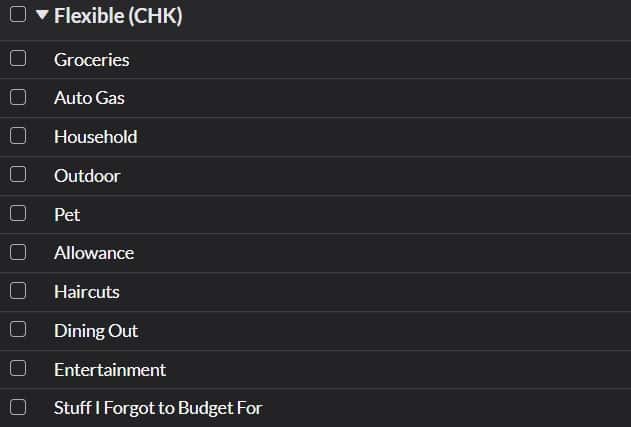

Flexible

The Flexible category is named such because money in each sub-category can be adjusted as needed. These are not fixed amounts required each month, but the amount of money in each sub-category can increase or decrease from monthly budget to monthly budget, or even within the days of a month’s budget. Sub-categories under Flexible are numerous and include

- Groceries

- Auto Gas

- Household

- Outdoor

- Pet

- Allowance

- Haircuts

- Dining Out

- School Lunch (our kiddo’s breakfast and lunch program at school)

- Entertainment

- Stuff I Forgot to Budget For

The amount of money budgeted for Groceries can vary from month to month, depending on many factors. Are you eating from the pantry (a.k.a. doing a pantry challenge) this month, or do youe need more money to stock up on various items going on sale in the summer? Is money tight this month and you need to make do with less? There are many reasons why the grocery budget amount can be flexible, so let it flex in your budget!

Same for the Auto Gas sub-category – are you planning on driving more in the budget month? Are gas prices trending up or down? One reason we might budget less money in Auto Gas is because Mr. Clumsy Gazelle can drive his work vehicle home during certain times, which means we save a tank of gas that week.

Household, Outdoor, and Pet – do you have larger expenses coming up for these subcategories? For example, is it almost spring, and you can’t wait to decorate your outdoor space with new flowers & bulbs? The cost of pet food, supplies, toys, and treats are included in the Pet sub-category; depending on how much money there is to go around, you may be able to fund a few extra special expenditures for Fluffy and Fido this month, or you may just need to meet their basic needs this month if money is tight.

All of the sub-categories in the Flexible category have some ability to increase or decrease as needed, but they are still pretty important expenses that need attention. Also, notice the last sub-category of Stuff I Forgot to Budget For – this is a catch-all line we usually fund with about $50-$75 dollars, for those weird situations when, well, “we forgot to budget for that.” Maybe you needed parking fees for your annual trip to the museum downtown, or you felt extra generous tipping for your haircut this month. The Stuff I Forgot sub-category money is there to help cover those expenses.

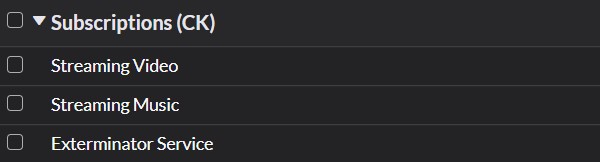

Subscriptions

These days, who doesn’t have subscriptions, amirite? Music, streaming services, meal kits, even our monthly pet medical fees. Subscriptions can be a bit quirky – some have a time committment, while others can be cancelled when you want. Our Subscription category includes exterminating services, HVAC service contract, and toll money – all things that we plan to use, but unless they have a binding time committment, we could stop them and omit that amount from our budget. They are a bit in between the Immediate Obligations and Flexible categories – not a must, but a regular, nice-to-have expense to plan for.

Your Subscription category may look different than this, or you may tuck the items in these sub-categories in another place in your budget. That’s the great thing about a personal budget: it’s personal! You get to choose which categories and sub-categories make the most sense to you!

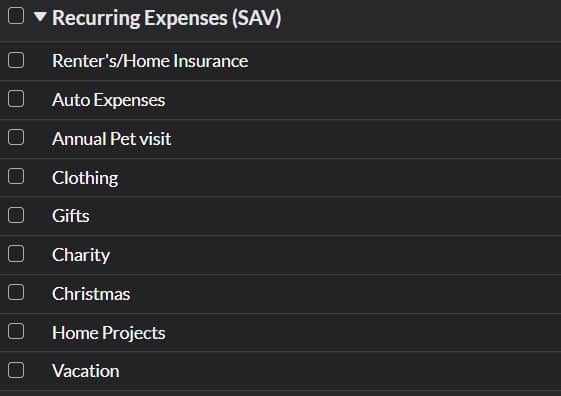

Recurring Expenses

This category is home to expenses that come around infrequently – maybe quarterly, annually, or some other odd timing. The thing is – these expenses are important, so when you need to spend the money on that expense, you need money there earmarked for that purpose! Some examples include

- Auto – registration, taxes, inspections, insurance, regular maintenance (oil change, etc)

- Annual pet medical fees

- Clothing

- Gifts (we use this sub-category for birthdays and special event gifts)

- Christmas

- Home projects

- Vacation

- Charity

Think of expenses that come around only once-in-a-while, but can blow your monthly budget or worse, generate debt. These go under Recurring Expenses. How do you know how much to put in each line? Well, that can vary. If something has a once or twice a year payment, we just take the total amount and divide by the number of months. For example, our HOA payment is due every January, so the total cost / 12 months is how much we put in that sub-category each month.

Clothing, however, is different. We like to keep about $100 in that sub-category so if we need to go clothes shopping, we have a good start without affecting our budget. If Clothing already has $100 in it from last month, and we don’t foresee any large clothing purchases, we may skip funding that sub-category for a month. But if a large purchase is in the future, like back-to-school shopping or special clothes for an event, we will add more money to that sub-category so we are prepared. Clothing is a very personal thing, so maybe you will have a different philosophy, but knowing that I can pick up a nice item for Mr. CG or me on a whim, or have funds ready for a new pair of shoes for a rapidly growing kid whose toes are actually wiggling through the toe of his old shoes (true story!) is a peaceful feeling.

We do the same for the Gifts sub-category, by keeping a minimum amount in there each month. Again, sometimes that amount increases for special occasions so we plan ahead by adding more to that sub-category, but the same idea is at play – if I need to pick up a gift for someone unexpectedly, there is money earmarked for that purpose and I don’t worry about blowing our budget.

Christmas is yet another different story. Every month, starting in January, we assign money to the Christmas sub-category. In theory, we guess at what amount we want to spend on Christmas, then divide by 12 and put that amount aside each month, so when Christmas comes we have cash ready to spend! However, what actually happens is WAY BETTER. Let’s say it’s May, and we find the perfect gift for someone. I don’t wait until Christmas to spend the Christmas money, I buy the item then! Why? I can pay for the gift in cash, I can put the gift aside, and that’s one less gift on my gift list during the holiday season! Win-Win-Win! It took this Clumsy Gazelle longer than I’d like to admit to figure this out, but this trick has worked beautifully over the past few years. In fact, Christmas is several months away, and I’ve already stashed some gifts for this year! If we decided to add back money to the Christmas sub-category after early spending on gifts, we can – or not. Either way, planning ahead for Christmas each year makes the holiday season less stressful and more joyous, while still avoiding debt.

The last few sub-categories, Home Projects, Vacation, and Charity, help capture spending events that don’t fit well under monthly categories. Home Projects could include new furniture, home repairs, or some other large expense. Sometimes these items are planned over several months, allowing for a regular contribution to saving up for the project. Other times, perhaps a project is a holding place for leftover money (yes, it can happen!) after the budget is funded for the month. Vacations vary widely from person to person in value, frequency, and duration, but ALL vacations are better when they are paid for in cash. (Source: the Clumsy Gazelles, who used to take vacations on credit, but now have taken multiple vacations with cash and have NO REGRETS.) Charity also looks very different for each person – some contribute regularly to organizations they value, while others contribute when they see a need. Either way, all three of these sub-categories capture intentional saving and spending within a budget. For example, the contributions may vary from $50 leftover from last month’s budget up to $500 from a work bonus, tax return, or other financial windfall. Alternatively, contributions may look like a consistent amount added to the sub-category each month at a rate that will ensure cash funds are available when the spending occurs.

Just like with every other part of a budget, the Recurring Expenses category is a place to save and spend money with a purpose, even if the spending occurs irregularly.

Credit Card Payments

Why, you ask, are credit card payments in a category of their own? Quite frankly, there are two reasons: first, since we eliminated all non-mortgage debt, Mr. Clumsy Gazelle and I use credit cards to pay for nearly everything we purchase, so money allocated for Groceries, then spent on groceries using a credit card, becomes part of the credit card payment. I’ll explain that more below. Second, in general, people tend to have lower outstanding balances on credit cards than other non-mortgage debt such as a car loan, so in theory extra money available in the budget can go to a credit card payment to pay down the balance and eliminate that debt sooner than making minimum payments would.

What do I mean by Grocery money becomes Credit Card payment money? To clarify, we carry no balance from month to month on our credit card, so it is paid off in full before the due date each month (actually, multiple times per month, but I digress). We do this because it works for us, but it may not work for everyone – use your best judgement. At the grocery store, a $50 purchase is paid for with the credit card that starts with V (you know the one). As a result of that transaction, $50 leaves the Grocery sub-category and is moved to the Credit Card V payment category. If there was $500 in the Grocery sub-category before the transaction, then there will be $450 in the Grocery sub-category after the transaction and $50 in the Credit Card payment category. Then, when it’s time for the credit card payment to be made, there is $50 waiting in the Credit Card payment category for that payment, along with other money from other transactions made.

In regards to an outstanding credit card balance that needs to be paid off: we’ve been there too, more times than I care to admit, but I can honestly say we have not been there in years, not since we committed to a written budget each month and no balance carryover on our credit cards, not ever. If I had three credit cards with outstanding balances, maybe Card A with $4500, Card B with $900, and Card C with $3300, that I was no longer using for purchases, this is how I would handle funding their sub-categories:

- Card A ($4500) and Card C ($3300) would have the minimum payment amount budgeted each month

- Card B ($900) would have the minimum payment amount budgeted, along with any extra dollars the budget could spare to get that balance paid off ASAP.

If you prefer to pay off by interest rate, or by another method, it doesn’t change the idea that money is given the purpose of paying off the balance to eliminate the debt within your monthly budget. This is just how I would do it, because seeing that my sacrifice of money to remove a debtor from my life is incredibly motivating for me. Your money, your budget, your decisions, your life 🙂

Emergency Fund

The Emergency Fund category is a foundational part of any budget, no matter how large or how small. The purpose of this money is to simply exist, unspent, until an emergency happens. Every other line of the budget has a purpose and, often, a deadline, to be spent, except for the Emergency Fund. If you’ve never had an Emergency Fund, creating and maintaining one can be a different experience. Most financial sources suggest the size of an Emergency Fund should be about 3 months of your expenses, and of course the amount is a personal decision, but truthfully ANY amount is better than none at all. These funds are reserved for relief during unplanned life events that may not even be your fault! At some point, the fund may need to be created and funded, so contributions can be tracked with this budget category. Hopefully the need to replenish the funds will be a rare occurrance, but could become a temporary part of a monthly budget as needed. If you don’t yet have a designated Emergency Fund, give serious thought to creating one.

Other Categories or Sub-categories

Is this the end-all list of budget categories? Definitely not! Budget categories and sub-categories can be as broad or as focused as you need for your budget to serve you well. As long as every dollar coming into your budget has a purpose to meet your needs (and wants!), feel free to add, remove, edit or rearrange any category to suit you.

For example, if you tend to view anything that you consume as Food, regardless of its source (i.e. grocery store, restaurant, fast food, convenience store, or even school dining plans), maybe you only have a minimalist Food category, and all spending on consumables is tracked there. On the other hand, maybe you have a desire to separate food purchased to prepare meals at home from food purchased at restaurants, so you have a Food category with Grocery and Restaurant sub-categories. Maybe you have school-aged children on meal plans that reduce the expenses of breakfast and lunch, but can be sizeable expenses each month on their own without actually being groceries available at home, so you have a Grocery sub-category and a separate School Meal sub-category.

It really doesn’t matter what list of budget categories you start with, just start with something. You will figure out what works for you over time, as you use your budget. Categories and sub-categories can change over time for even the experienced budgeter, so if you are an inexperienced budgeter understand that what you start with will not be what you always use. View your budget as a constant evolution over time, just like your finances evolve over time.

Finally, a helpful tip!

Some people may have a single bank account, where all their money comes into and out of, but frankly I think that is pretty rare. These Clumsy Gazelles have several bank accounts of different types (checking, savings, money marketing, etc), so viewing our finances through the lens of a single budget can get confusing – which money goes where? Very organized people may be able to house all Recurring Expenses in a single savings account and, with careful tracking of expenses and balances, keep the categories and sub-categories updated.

We are not that organized. Truth is, our budget can get messy, encompasses a lot of places for money to live, and “what money belongs where” can get confusing, especially when payday deposits into the checking account only. This tip works exceptionally well for us since we use YNAB for budget and expense tracking, but it can also work for folks with digital (read: Excel or Google Sheets) or even handwritten-on-actual-paper budgets and expense tracking: along with the title of each Category in your budget, label which account that Category lives in. Maybe you noticed the CHK, SAV, or MM abbreviation beside each category name in the photos above? In our case, the checking account is the home to our budget Categories of Credit Card payments, Immediate Obligations, Flexible, and Subscriptions. Recurring Expenses lives in the money marketing account, and the Emergency Fund has its own savings account. This way, we know at a glance what money lives where. Why is this important? In another article, I explain how to reconcile a budget, and this trick makes that process very easy!